Senate approves the 2026 Tax Miscellaneous Bill in general; opposition claims “digital espionage”

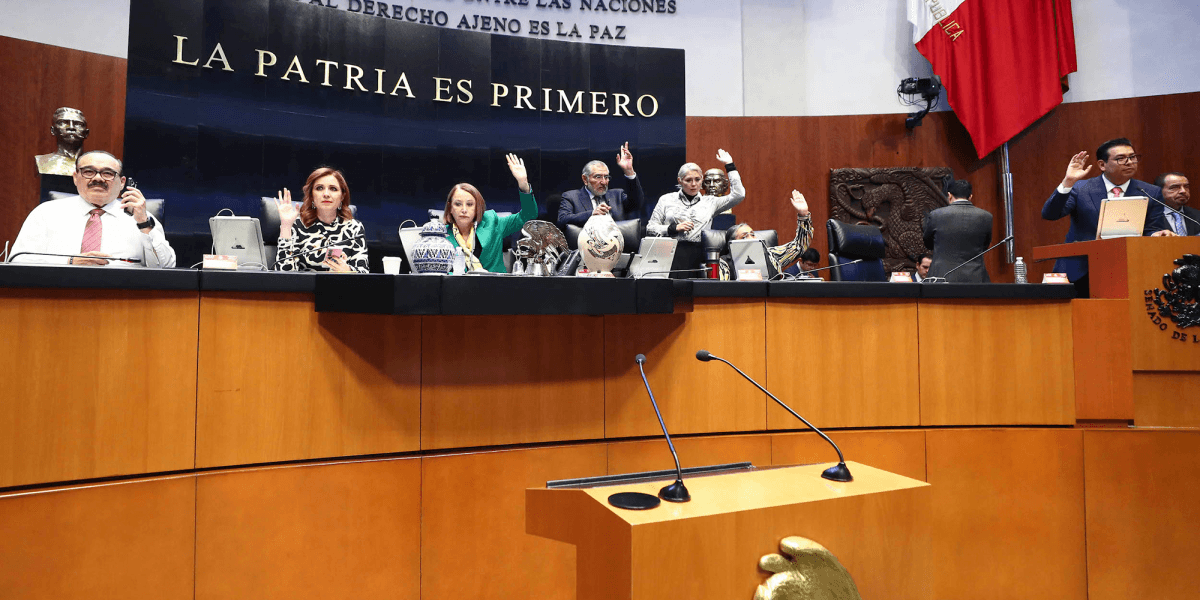

The Senate of the Republic approved, in general terms, the 2026 Tax Miscellaneous , which includes reforms to the Federal Tax Code (CFF), the Federal Law of Rights and the Law of the Special Tax on Production and Services (IEPS), amid criticism from opposition parties.

The session began amid tensions after PRI legislators attempted to block the start of the debate on Tuesday. Despite this, the ruling majority managed to advance the three bills, while the opposition accused the government of allowing " digital espionage " and imposing new taxes under the guise of promoting healthy habits.

Opposition parties warned that these measures will have a direct impact on the finances of Mexican families, while questioning the official narrative on public health and oversight.

With 76 votes in favor, 38 against and zero abstentions, the reforms were approved in general, thus beginning the discussion in particular of them before being sent to the federal Executive.

Although the reports arrived at the Board of Directors on the same day, the Senate decided to expedite the process to begin the discussion, even though it is usually 24 hours later that it is received at the Board.

However, two senators from the PRI party filed a motion to suspend the rulings, citing issues of unconstitutionality and complaints about the reforms to the IEPS (Special Tax on Production and Services).

“Once again, they are voting hastily and without a full understanding of the prices. I demand that the CFF ruling be returned due to its unconstitutional aspects,” stated Senator Claudia Edith Anaya of the PRI, who also accused the proposed modifications of fiscal terrorism.

Her fellow party member, who added another motion for suspension, indicated that despite the narrative that the IEPS updates are for public health reasons, the reality is that the government is only “trying to protect its coffers.”

What changes?Among the proposed modifications are the creation of an 8% IEPS tax on violent video games, an increase in the IEPS rate from 1.6451 to 3.018 pesos per liter for sugary drinks – including oral rehydration solutions that do not meet the recommended recipe – while for drinks that are “light” or “zero” it will be 1.5 pesos per liter.

The tax authorities are also given greater powers to strengthen the fight against so-called " invoice mills ," which are companies that issue tax receipts for non-existent transactions, as well as increasing fees and rates for some public services, including entrance fees to museums, sites and archaeological zones under the responsibility of the National Institute of Anthropology and History (INAH).

In addition, there are adjustments of up to 100% to immigration fees for visitors without work permits , temporary and permanent residents; establishing a 50% discount for humanitarian cases such as migration for family reunification, job offers or cultural invitations.

The approved reforms are part of the 2026 Economic Package. The Senate of the Republic still has pending the discussion in particular of the Tax Miscellaneous, as well as in general and in particular of the Federal Revenue Law (LIF) 2026, which must be approved before the end of October 31.

“These are not whims”During the presentation of the reports, Senator Rafael Huerta, from Morena, assured that the updates to the IEPS “are not whims”, but international recommendations.

“Every peso that comes into IEPS must return to the people in the form of care and well-being,” he said.

However, several senators pointed out that although it is said that the resources will go to health, the government does not earmark the resources for programs related to the diseases caused by the consumption of tobacco and/or sugary drinks.

Later, opposition senators pointed out that these levies are "disguised" as healthy taxes; however, they only expose the need to raise more money.

“The true objective of this measure (the excise tax on violent video games) is not to reduce violence, but to raise more revenue. What this proposal does reveal is the poor state of public finances. When a government seeks to impose taxes on entertainment products under the guise of protecting public safety, what it is really acknowledging is its inability to maintain a responsible budget,” stated Néstor Camarillo of the Citizens' Movement.

Regarding the proposed modifications to the Federal Tax Code , which require digital platforms to provide real-time information to the SAT (Tax Administration Service), PRI Senator Cristina Ruíz Sandoval scoffed at the notion that this was "modern tax enforcement," asserting that it was not efficiency, but rather espionage.

“They want a tax authority with eyes everywhere, except where the real criminals are,” he asserted.

Meanwhile, Imelda San Miguel Sánchez, a member of the National Action Party (PAN), described the powers granted to the tax authorities as "excessive," all in order to spy on every Mexican man and woman under a law she called a "spy law."

Eleconomista